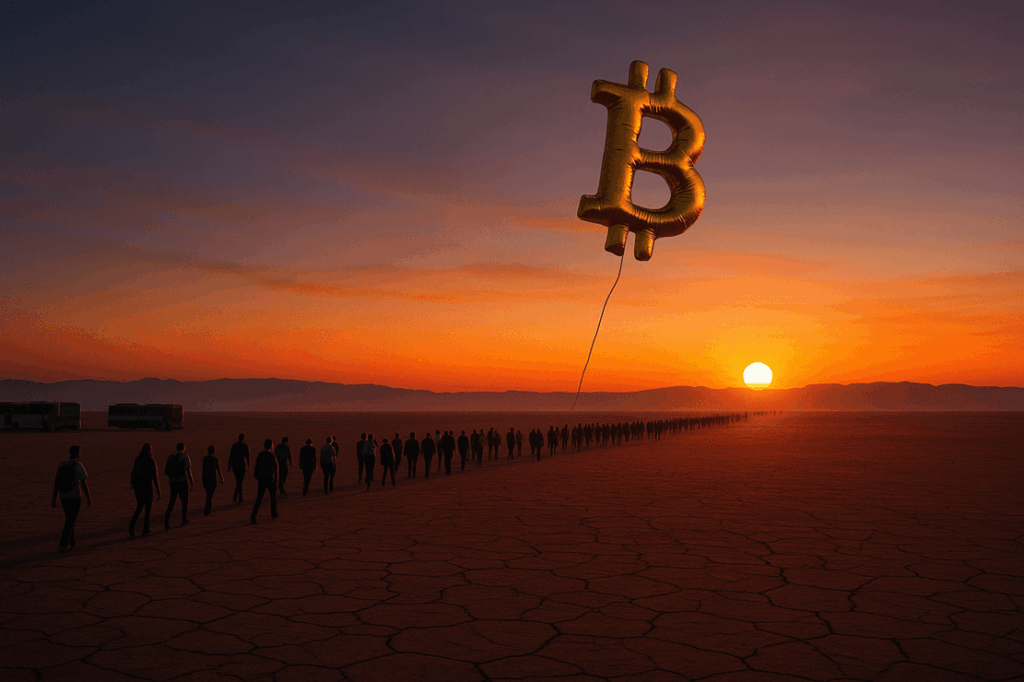

Bitcoin’s recent price fluctuations have sparked uncertainty among investors, with many questioning whether the bull run is coming to an end. The market dynamics are being closely scrutinized, particularly the actions of whales and the sentiment among retail investors. Understanding these factors is crucial for navigating the complex crypto landscape.

Whales Exiting, Retail Investors Lagging

Recent data from CoinGecko highlights a surge in Bitcoin’s volatility, leading to a sense of unease in the market. Whales, large holders of Bitcoin, are reportedly offloading their positions, adding to the selling pressure. On the other hand, retail investors seem to be slow in their response to these market shifts.

The Significance of Whale Movements

Whale activities in the crypto market often serve as leading indicators of potential price movements. When whales start to sell off their holdings, it can signal a bearish sentiment and trigger a cascade of selling among smaller investors. This phenomenon can exacerbate price declines and lead to increased market volatility.

Expert Analysis from Sam Boolman

According to Sam Boolman, ChainIntel’s lead analyst, the current market conditions require a cautious approach. Boolman emphasizes the need for investors to diversify their portfolios and conduct thorough research to mitigate risks associated with market uncertainties. He suggests that closely monitoring whale activities can provide valuable insights into the market’s future direction.

Preparing for Market Uncertainties

As the crypto market braces for potential shifts, investors are advised to stay informed and seek guidance from reputable sources. Diversification remains a key strategy to hedge against unforeseen events and reduce exposure to market volatility. By staying proactive and adaptable, investors can better position themselves to navigate the evolving market landscape.