EU Prepares Retaliation Versus United States Tariff Increases

The European Union revealed strategies to retaliate against a United States tariff trek on steel imports, intending to impose its own tariffs targeting essential US goods. This relocation has magnified the trade stress in between the 2 economies. The escalation in tariffs is anticipated to affect global trade characteristics, with potential effect on market stability and economic conditions. Investors and companies are carefully keeping an eye on the advancements for prospective repercussions.

EU Targets United States Product Amidst Intensified Trade Disagreement

The European Union’s decision to retaliate came after the United States increased tariffs on steel imports, affecting European exports. The EU’s reaction targets delicate American products, highlighting a magnified trade conflict between the 2 entities. Key products such as soybeans, agricultural products, and motorcycles are included in the EU’s list, mostly from politically impactful states like Louisiana, a significant producer of farming exports, linking US internal politics. These actions by the EU indicate a double approach, focusing on settlement attempts while simultaneously preparing for severe countermeasures if needed. The commission expressed regret over the US’s failure to advance with negotiations to reach a bilateral trade deal. Market responses have been mixed, with investors cautious of potential disruptions in trade flows. Recent market activities show fluctuations in American and European equity-index futures as the situation unfolded. Asian stock indices experienced increases, showcasing variable impacts across global markets.

Cryptocurrency Markets Remain Volatile Amidst Global Trade Tensions

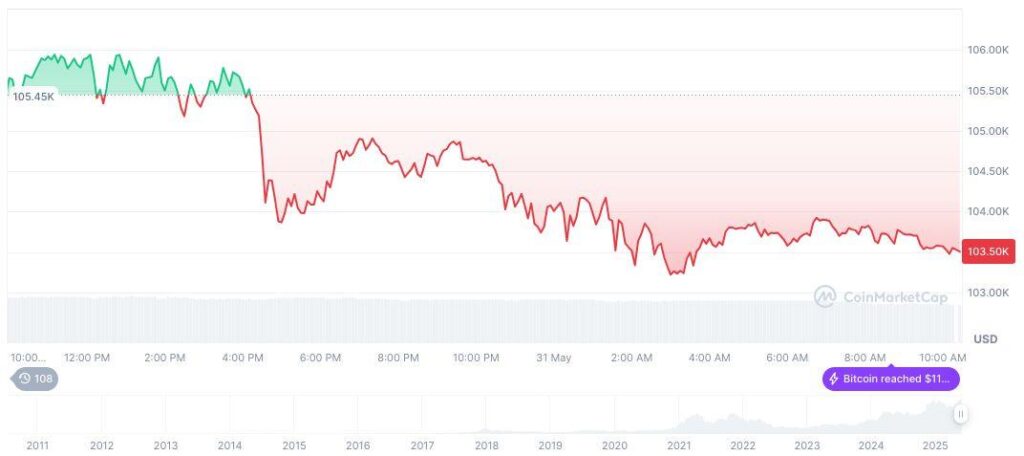

Did you know? The current tariff disagreements echo previous EU-US trade conflicts, following several years of back-and-forth on tariffs concerning steel and other industrial products crucial for cross-continental financial health. As per CoinMarketCap, Bitcoin’s current price of $104,627.45 contributes to a market cap of around $2.08 trillion, with a dominance of 63.42%. The circulating supply has almost reached its maximum, standing at 19.87 million out of an available 21 million. The last update indicates a 0.59% increase over 24 hours, with significant changes recorded over recent days and months. Insights from the Coincu research team reveal that the EU-US trade tensions might further impact the volatility seen in cryptocurrency markets. Economists may anticipate potential shifts due to changes in trade dynamics, with analysts predicting impacts that may not be critical but immediately observable for future monetary policy decisions.