Asia Ditches Treasuries Amidst Rising US Financial Obligation Worries

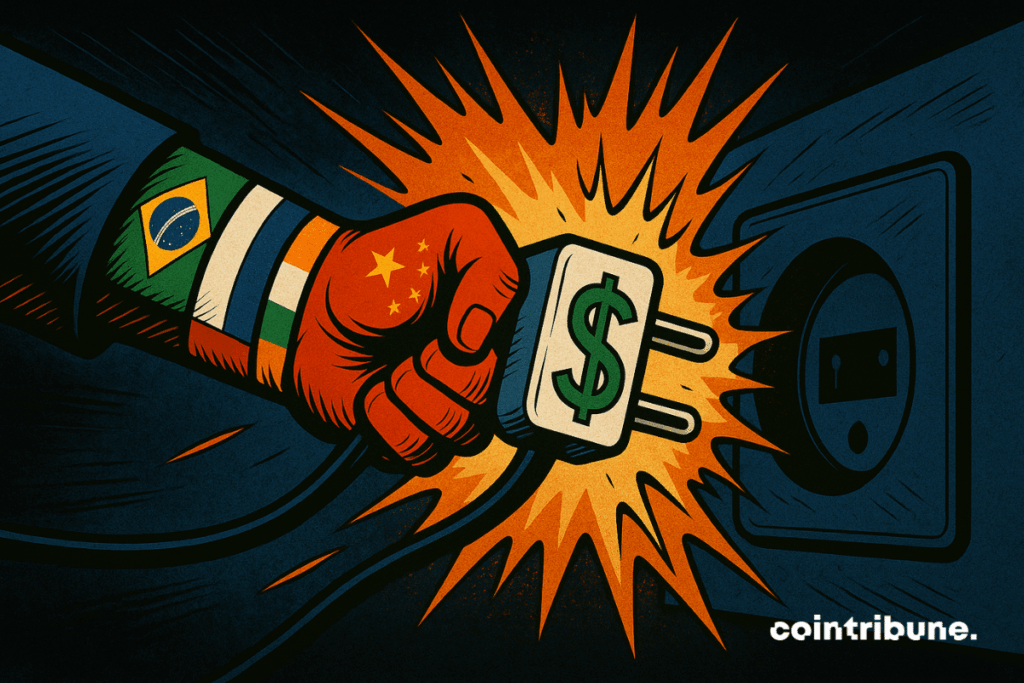

What if one of the biggest capital transfers in modern history was already underway, far from the spotlight? Confronted with increasing geopolitical tensions and the faltering dollar-dependent design, Asian countries, led by the BRICS, have begun withdrawing about $7.5 trillion in American assets. This reorientation, based on concrete data and strategic options, challenges Western financial foundations and declares a definitive but quiet reshaping of the global financial order.

An Asian Disengagement Already Underway

China, an influential BRICS member, is gradually decreasing its holdings of U.S. Treasury bonds, a choice that is causing growing concern in international markets. For numerous months, a substantial but discreet movement has been emerging. Other BRICS members and numerous Asian nations are following this momentum by also initiating a withdrawal from American monetary assets, mainly Treasury bonds. This withdrawal is currently underway and fits into a logic of diversifying foreign reserves. Here are the most crucial accurate aspects:

- China has sold $150 billion of U.S. Treasury bonds in 2024, in a clear effort to reduce its dollar exposure;

- This disengagement is not limited to China: other emerging economies within the BRICS bloc have begun liquidating their dollar assets to convert them, especially, into gold, considered more secure;

- Such a trend marks the end of a dominant economic model for years, where Asia exported to the United States and then reinvested the profits in U.S. debt;

- Experts estimate that $7.5 trillion of Asian assets are still exposed to U.S. markets, an enormous sum, whose potential withdrawal would represent an unprecedented event for the American economy;

- This shift is directly connected to the growing loss of confidence in the U.S.’s budget stability, whose debt has exceeded $36 trillion.

This strategic realignment is therefore not a theoretical anticipation: it is already underway. It originates from a desire to regain control over sovereign reserves, in a context of increasing trade stress, geopolitical fragmentation, and growing mistrust towards the United States’ financial trajectory.

The Rise of a New Financial Order Led by Emerging Countries

Beyond asset sales, it is the very logic of the post-World War II system that is being questioned. As Virginie Maisonneuve, head of investments at Allianz Global Investors, states: ‘We are witnessing a change in the global order, and I do not think we will return to the way things were before.’ According to her, this movement is largely linked to China’s rise, particularly in technological and financial fields, which pushes emerging nations to assert their financial sovereignty more strongly.

Together with the disinvestment, many countries are increasing their gold reserves and moving away from the dollar, which is increasingly seen as risky. The U.S. financial context, with debt now exceeding $36 trillion, increasingly worries foreign decision-makers. They fear a medium- to long-term devaluation of the greenback, and consequently a decline of their holdings. This phenomenon now impacts all of Asia beyond the BRICS, in a potentially lasting financial diversification movement.

If this trend accelerates and solidifies, the consequences could be severe for the United States. Losing their privileged status as a destination for foreign reserves would reduce their financial influence, as well as weaken their ability to finance themselves at low cost. The diminishing dollar could then lose part of its global supremacy with disastrous consequences, benefiting alternative assets or new reserve currencies that certain BRICS members, led by China, seem determined to promote. The chapter of the dollar-centered global monetary system is not yet closed, but the first lines of its epilogue may already be written.