French Authorities Charge 25 in Crypto Kidnapping Case

French authorities have charged 25 people, including six minors, in connection with kidnappings targeting the cryptocurrency industry in France. These incidents highlight the vulnerability of high-net-worth crypto holders and heighten conversations about personal and industry-wide security measures.

The Paris Prosecutor’s Office announced charges against 25 people for kidnapping and attempted kidnapping. These suspects, aged 16 to 23, reportedly targeted popular figures in France’s cryptocurrency sector, including the family of Pierre Noizat, CEO of Paymium. Nineteen suspects remain in pre-trial detention, while the rest face judicial and legal proceedings.

Bruno Retailleau, France’s Interior Minister, has pledged to enhance security measures to protect industry players, stating: ‘The financial impact has been limited, with no direct evidence linking these events to changes in cryptocurrency asset prices.’ Substantial wealth was involved, ransom demands ranged between EUR5 and EUR7 million and were expected to be paid in cryptocurrency. No significant transactional shifts have occurred within private or public exchanges, as neither Total Value Locked (TVL) nor liquidity levels show signs of fluctuation.

Crypto community responses stress increased security concerns among high-net-worth individuals. Public discourse on platforms like Twitter and Reddit reflects anxiety, while market leaders like Pierre Noizat and key figures such as Arthur Hayes, CZ, or Vitalik Buterin have made no public statements. Community discussions remain active, and French authorities continue to collaborate with key stakeholders to ensure better protections for those at risk.

Crypto Community Concerns and Historic Precedents

In 2019, a Netherlands crypto trader was kidnapped for Bitcoin ransom, raising awareness for crypto community security globally. Similar events have led to enhanced privacy measures among crypto wealth holders to mitigate kidnapping risks.

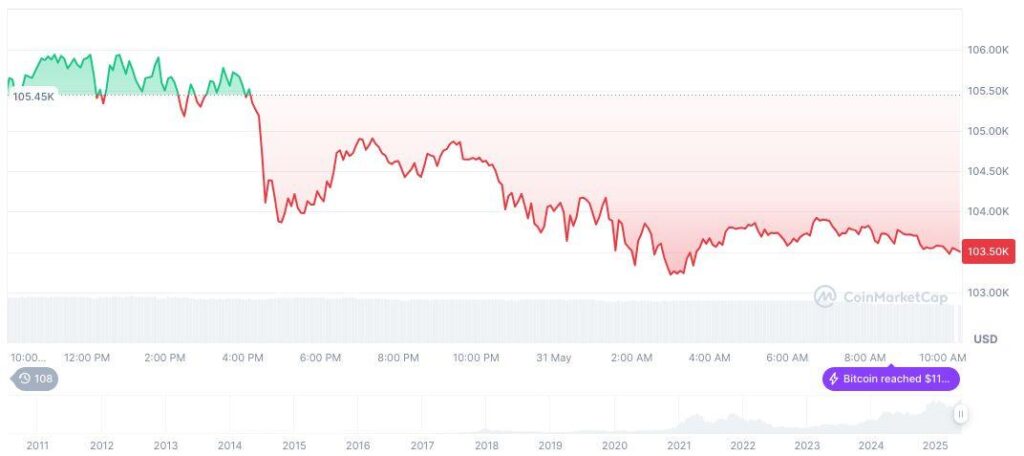

CoinMarketCap reports Bitcoin, currently traded at $103,928.43, holds a market cap of $2.07 trillion with a dominance of 63.63%. Trading volume over 24 hours is $35.67 billion, noting a 31.22% reduction. The asset price fluctuated, with a 0.34% increase in 24 hours, a 2.97% dip over 7 days, and significant increases of 7.51% in 30 days, 22.24% over 60 days, and 13.00% for 90 days.

Insights provided by the Coincu research team emphasize potential security enhancements within regulatory environments as crucial in the crypto landscape. Past precedents highlight rising personal security standards, and ongoing coordinated responses suggest possible advancements addressing underlying vulnerabilities in wealth protection strategies.