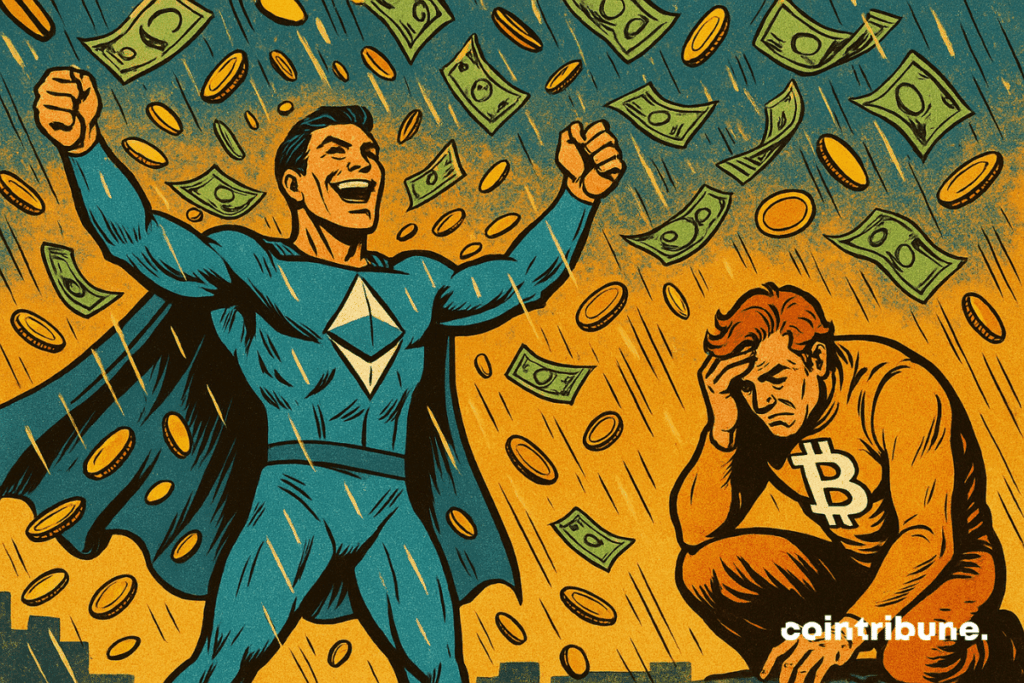

Crypto: Ether ETFs Are Booming

The crypto universe has never lacked spectacular events. This time, it is the Ether ETFs that are stealing the spotlight. Far from being just a simple financial product, they crystallize an underlying dynamic: the institutionalization of Ethereum. With a series of capital inflows nearing a billion dollars, a wave of euphoria is sweeping throughout the markets. And this may just be the beginning.

The crypto universe has never lacked incredible moments. But this time, it is the Ether ETFs that steal the spotlight. Far from being just a simple financial product, they crystallize an essential dynamic: the institutionalization of Ethereum. With a series of capital inflows nearing one billion dollars, a wave of euphoria is sweeping throughout the markets. And this might well be just the beginning. A dynamic that does not weaken: 15 days of huge inflows Since May 16, Spot Ether ETFs have shown a continuous series of 15 days of inflows. A raw figure? $837.5 million in three weeks. An achievement, but above all a strong signal: investors’ appetite for ETH crypto is no longer just speculation, it enters a logic of structured accumulation. At a time when Bitcoin struggles to maintain its course, with $346.8 million outflows on its ETFs at the end of May, Ether plays the stability card. This performance alone accounts for 25% of the total net flows since the launch of Ether ETFs in July 2024. According to data aggregated by Farside, if the trend continues one more week, the symbolic $1 billion mark might be crossed, consolidating Ether’s status as an alternative safe haven to BTC. This interest finds a direct echo in the spot market: +31% in one month, with a price currently flirting around $2,490. The market seems to be discovering Ether with the interest of a collector finding a Picasso at a flea market. Towards a new historic peak for ETH crypto? Technical indicators are not left behind. Analysts like Crypto Eagles mention a fractal of gold in mirror of Ether’s current behavior. In short: a price structure observed on gold over several years seems to be repeating today on ETH, suggesting a potential rise towards $6,000 in the coming months. This is not just a maximalist dream. In November 2021, Ether already reached $4,878. If macroeconomic conditions support and adoption continues to climb, it would not be unreasonable for this limit to be shattered. Specifically as the impending arrival of staking ETFs, enabled thanks to regulatory bypasses by companies like REX Shares, could add a layer of yield that is sorely lacking in existing ETFs, as Cointelegraph reports. The integration of staking into Ether ETFs would not be insignificant: it would generate passive income while maintaining exposure to the token, a formidable mix for asset managers. In short, an evolution capable of truly shaking things up. An institutional validation, a quiet revolution Beyond numbers and bullish promises, this rally of Ether ETFs highlights a fundamental but silent shift: crypto is entering adulthood. What was long a playground for cypherpunks and speculators is becoming a legitimate asset for global savings managers. The ripple effect could strengthen. Increasing adoption of Ether ETFs by pension funds or insurance companies could further move ETH crypto into the global financial landscape. Because where millions are injected, billions follow. The current success of Ether ETFs is therefore not just a market anecdote: it is the sign of a shift. That of a crypto asset that stops being “alternative” to become essential like BTC.