A Start-up Is Seeking To Pay 30% Yield by Tokenizing AI Infrastructure

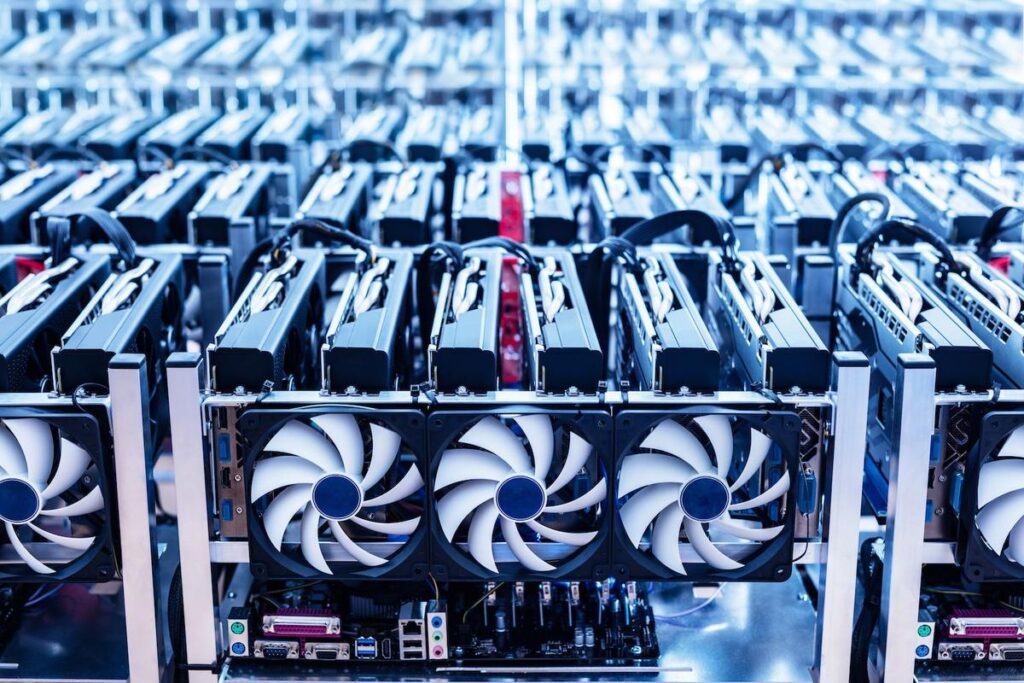

Compute Labs’ tokens offer fractionalized ownership of industrial-grade NVIDIA H200 GPUs, which would retail at around $30,000 for a single unit.

Compute Labs, a startup that turns the industrial-grade GPUs that power AI data centres into fractionalized yield-bearing tokens, and business AI cloud company NexGen Cloud, have joined forces to begin distributing ownership of a $1 million “public vault,” the business said on Wednesday. The power and profitability of AI facilities are mainly centralized and normally restricted to hyperscalers like AWS or large venture-backed companies. Compute Labs is attempting to bring its token holders direct access to the making potential of enterprise hardware such as NVIDIA H200 GPUs, which would retail at around $30,000 for a single system. “For financiers, this pilot [job] represents the first-ever chance to make stablecoin yield straight from live AI calculate without having to handle the hardware or rely on miscalculated public equities,” Compute Labs stated in a news release. Europe’s NexGen, which offers its clients access to AI calculating power and had raised $45 million in April, will deal with the initial financing through its financial investment arm InfraHub Compute.

How it works

The funds raised will be utilized by InfraHub to buy GPUs, which will then be fractionalised for financiers and clients, according to the press release. The first “vault” has currently raised $1 million from financiers. The preliminary vault will have top-of-the-range NVIDIA GPUs, which are presently utilized for “AI training and reasoning,” the firm stated. The companies are forecasting to have a yield, in USDC, that might go over 30% annually based on active enterprise GPU rental agreements. Nikolay Filichkin, primary company officer at Compute Labs, speak with the kind of information center operators who may have additional floor space and are looking to add additional capacity; the data center equivalent of “mother and pop shops,” he said in an interview with CoinDesk. “When the data center is utilizing the GPU owned by an investor, Compute Labs manages that through its procedure and balance sheet, and rents the GPUs to the data center,” Filichkin said in an interview. “The net income, minus things like hosting and energy costs, returns to the financier who owns a slice of the GPU processing power.” The firms tokenize and fractionalize these GPUs within the vaults, which can then be offered to individual investors in increments of a couple of hundred dollars. NFTs are also utilized to compare varying types of tokenized GPU hardware investments. Compute Labs is backed by Protocol Labs, OKX Ventures, CMS Holdings and Amber Group, to name a few. The firm runs with a flat 10% cost structure throughout tokenization, possession management and efficiency yield. “This model assigns concrete, tradable worth to each GPU cycle, rationalizing the AI market by getting rid of the speculation of investors, and directly connecting demand, price, and supply,” stated Youlian Tzanev, co-founder and chief method officer at NexGen Cloud.

Europe’s NexGen, which offers its consumers access to AI calculating power and had actually raised $45 million in April, will handle the preliminary funding through its financial investment arm InfraHub Compute. “When the information center is utilizing the GPU owned by an investor, Compute Labs manages that through its protocol and balance sheet, and rents the GPUs to the information center,” Filichkin said in an interview. Compute Labs is backed by Protocol Labs, OKX Ventures, CMS Holdings and Amber Group, among others.