DOJ Ties Kansas Bank Collapse to $225 Million ‘Pig Butchering’ Seizure

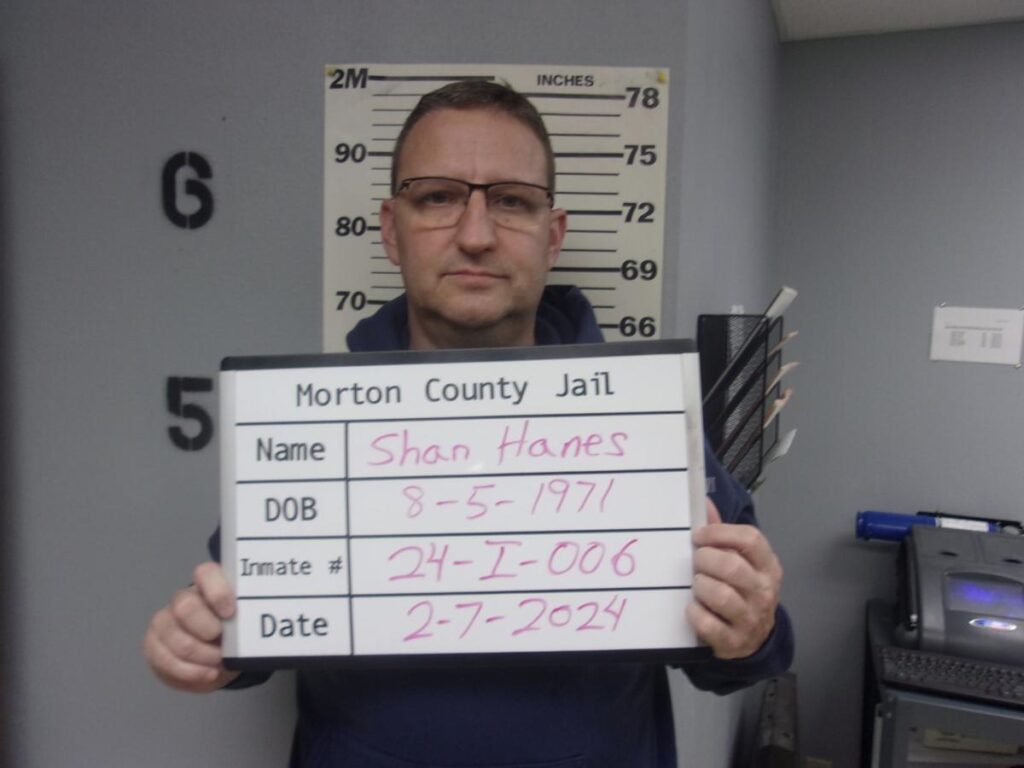

A Kansas banker who robbed millions from his small-town bank in 2023, and activated its collapse, lost much of the cash to abroad crypto fraudsters targeted in a record-breaking DOJ bust, according to a problem filed Wednesday. Prosecutors have actually filed a civil forfeiture action targeting over $225 million in laundered USDT, part of a butchering scam with ties to a Philippines call center that ensnared Shan Hanes, the disgraced former CEO who embezzled $47 million from Heartland Tri-State Bank, a theft which was straight credited to the farming loan provider’s death in 2023. According to the Department of Justice problem, OKX, a crypto exchange, provided crucial information that assisted determine a detailed network of accounts on the exchange utilized to launder the crypto proceeds. Scammers laundered funds by very first directing victims to send out USDT to 93 scam-controlled deposit addresses. From there, the funds were routed through as lots of as 100 intermediary wallets in a process created to obscure the source of funds and mix deposits from numerous victims, according to the complaint. These washed funds were then funneled into 22 primary OKX accounts and further shuffled across 122 additional OKX accounts, all connected by shared IP addresses, reused KYC files, and coordinated behavior apparently traced to a Manila-based scam substance, which the grievance names as ITECHNO Specialist Inc. In total, the DOJ says that roughly $3 billion in transaction volume was generated by this laundering network.

Largest victims In overall, the DOJ says there were 434 victims and has actually determined 60 of them who lost a combined $19.4 million. The biggest of these victims was Hanes, with the DOJ identifying $3.3 countless the $47 million he embezzled in this seizure. Hanes embezzled the cash between May 30, 2023, and July 7, 2023, according to both the DOJ problem and the Federal Reserve’s report into the collapse of Heartland Tri-State Bank, one of the banks to collapse in the consequences of the 2023 U.S. banking crisis. During this six-week period, Hanes initiated 10 wire transfers amounting to around $47.1 million from Heartland Tri-State Bank, a little community loan provider concentrated on agricultural loans, to a crypto wallet he controlled. These wire transfers happened in between the bank’s quarterly regulatory reporting periods, allowing the activity to go at first undetected. At the time, Heartland was well-capitalized with $13.7 million in capital and $139 million in possessions, however Hanes’ actions depleted its liquidity, set off $21 million in emergency situation borrowing, and left the bank with a $35 million capital hole, forcing regulators to shut it down in July 2023. According to prior reporting from CNBC, Hanes also took $40,000 from the Elkhart Church of Christ, $10,000 from the Santa Fe Financial Investment Club, $60,000 from his child’s college fund, and liquidated nearly $1 million in stock from a firm called Elkhart Financial to send to pig butchering scammers. He was sentenced to 24 years in prison in August 2024. The DOJ problem referred to him as both a wrongdoer and a victim. Seized crypto likely going to Fed stockpileCrypto seized by the U.S. government, such as in this case, is most likely to be allocated for a not-yet-established stockpile bought by President Donald Trump. The bitcoin BTC reserve and the stockpile of other cryptocurrencies have not yet been formally developed, however the Treasury Department has actually been leading an audit of governmental digital asset holdings to identify what needs to be collected. Once established, the long-term crypto holdings will likely put seized bitcoin in one fund and other kinds of tokens in another. The holdings in this case seem in substantial quantities of USDT, according to the filing. It’s uncertain what funds may become returned to victims, as only a relatively small percentage of those straight harmed have actually been identified.

A Kansas banker who robbed millions from his small-town bank in 2023, and triggered its collapse, lost much of the money to overseas crypto scammers targeted in a record-breaking DOJ bust, according to a problem filed Wednesday. District attorneys have submitted a civil forfeit action targeting over $225 million in washed USDT, part of a butchering fraud with ties to a Philippines call center that captured Shan Hanes, the disgraced former CEO who embezzled $47 million from Heartland Tri-State Bank, a theft which was straight attributed to the agricultural lender’s demise in 2023. The biggest of these victims was Hanes, with the DOJ recognizing $3.3 million of the $47 million he embezzled in this seizure. At the time, Heartland was well-capitalized with $13.7 million in capital and $139 million in properties, but Hanes’ actions depleted its liquidity, activated $21 million in emergency borrowing, and left the bank with a $35 million capital hole, requiring regulators to shut it down in July 2023.