Binance Alters Leverage and Margin for LRCUSDT and PHBUSDT

Binance will make modifications to the leverage and margin levels of select perpetual futures contracts, impacting LRCUSDT and PHBUSDT, starting June 6, 2025. The update aligns with risk management procedures for highly leveraged derivative markets, although it is independent of any institutional funding or capital inflows.

Binance Updates Leverage for LRC and PHB Futures

The world’s largest centralized exchange, Binance, announced adjustments to its perpetual contract offerings. These changes will affect the leverage and margin levels for LRCUSDT and PHBUSDT futures, effective June 6, 2025. Existing positions will be affected, necessitating strategic adjustments from users. Binance CEO Richard Teng’s absence from public comments indicates a routine update through official channels.

These modifications follow Binance’s risk management protocol for its derivatives offerings. With a focus on mitigating potential liquidation risks, current user positions in impacted contracts may require recalibration before the enforcement date. This decision does not involve any new capital infusion, remaining within operational risk management guidelines.

Market and community responses have been subdued, with no notable announcements from prominent individuals or government agencies thus far. This standard operational policy iteration underscores Binance’s proactive management of leveraged contract exposure in a volatile market environment. The absence of executive statements underscores the routine nature of these updates.

Crypto Market Maintains Stability Amid Leverage Adjustments

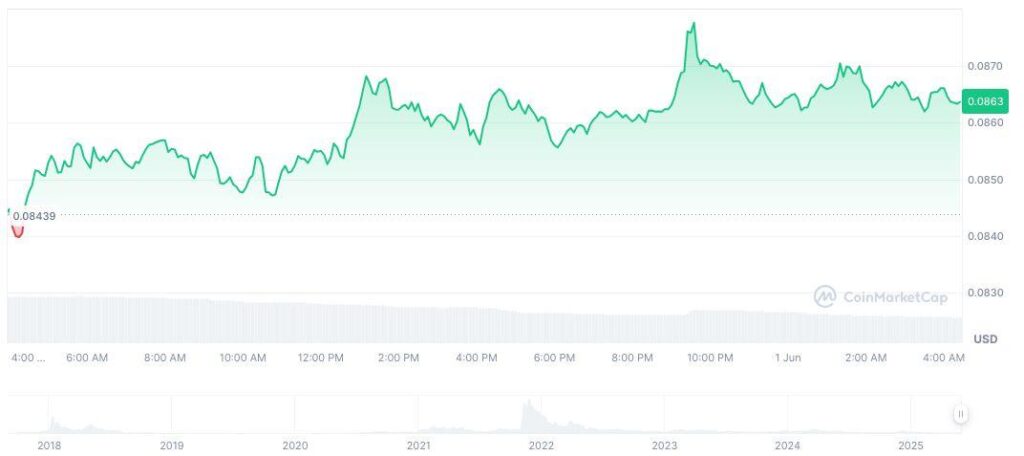

Did you know? Binance’s leverage adjustments mirror actions taken in early May 2025, indicating a consistent approach to handling high-risk derivative positions. Loopring (LRC) is currently trading at $0.09 with a market capitalization of $118.05 million. The asset has experienced a 2.43% price increase in the last 24 hours but has declined by 15.30% over the past 7 days, as reported by CoinMarketCap. Trading volume decreased by 43.99% last week, maintaining a volume of $11.18 million.

Industry insights suggest ongoing deleveraging trends in crypto markets involving futures. Binance adjusts its leverage offerings in response to market volatility indicators, displaying a broader emphasis on reducing user exposure to significant risks. Continuous monitoring of derivatives dynamics is advised by the Coincu research team.