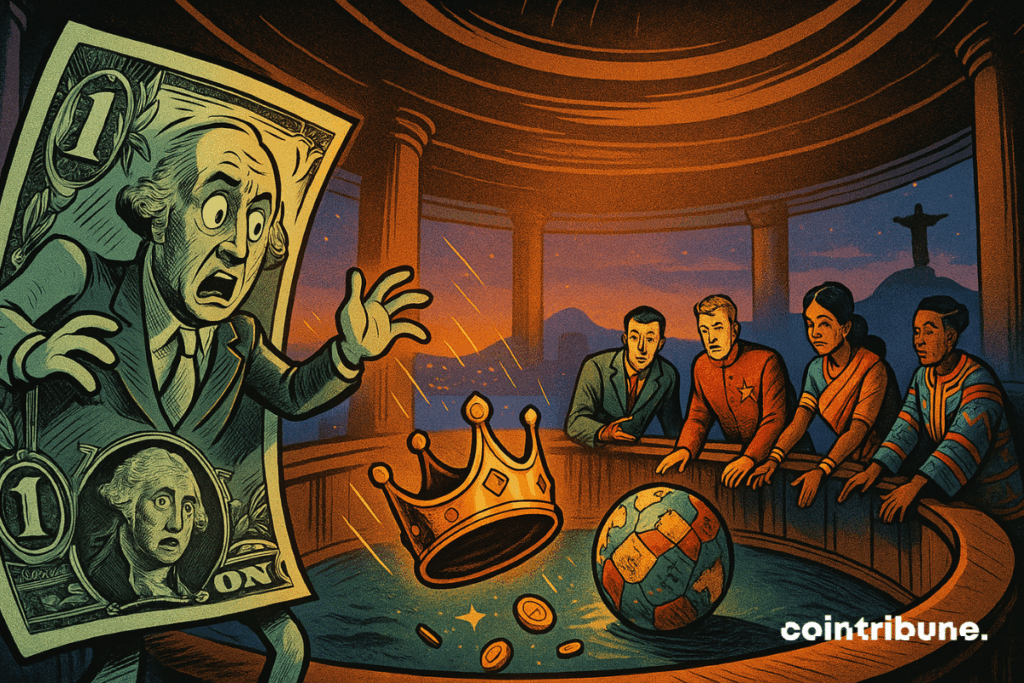

BRICS Plans New Trade Model Without The Dollar

Can the dollar lose its worldwide supremacy? Once speculation is now taking a concrete diplomatic turn, what was. As the BRICS top methods in Rio, major emerging economies are putting local currency deals at the heart of their technique. This shift occurs within a context of growing geopolitical stress and needs from the Global South for a more balanced monetary system. Behind this vibrant lies a possible redefinition of the rules of global trade.L’short article BRICS Plans New Trade Design Without The Dollar est apparu en premier sur Cointribune.

Can the dollar lose its global supremacy? What was speculation the other day is now taking a concrete diplomatic turn. As the BRICS top in Rio methods, significant emerging economies are putting transactions in local currencies at the heart of their method. This shift is set versus a backdrop of increasing geopolitical tensions and demands from the international South for a more balanced financial system. Behind this dynamic lies a possible redefinition of the rules of worldwide trade. Sell local currencies develops itself as a diplomatic priority While the dollar’s hegemony is concerning an end, Denis Alipov, Russian ambassador to India, specified that “the BRICS bloc is a serious platform to talk about common solutions to significant obstacles,” during a conference organized in New Delhi by the Brazilian embassy and the Center for Global Perspectives of India. The diplomat confirmed Moscow’s dedication to expanding trade exchanges in national currencies, noting that this system was already in use among certain members. He likewise sought to dispel suspicions about an anti-Western technique of the bloc: “the BRICS alliance is not a counter-bloc. It is a center of mass for nations looking for mutual respect and non-interference.” On the Brazilian side, Ambassador Kenneth da Nobrega also highlighted the efficiency of this approach: “it’s a long road. But sell regional currencies? It currently works.” This strategic instructions intends to enhance the financial durability of member economies in the face of turbulence in the dollar-dominated system. It fits within a context of increasing questioning of the international financial order, fueled significantly by American protectionist policies and the persistent danger of extraterritorial sanctions. In this regard, several points plainly emerge from these diplomatic exchanges: Sell regional currencies is currently a truth amongst some BRICS members, especially between Russia, India, and China; This dynamic goals to lower dependence on the dollar in bilateral and multilateral transactions; The project is not provided as a conflict with the West, but rather as a lever for financial emancipation; The effort enjoys broad diplomatic consensus, unlike more delicate concerns such as the typical currency or bloc governance; The integration of brand-new members such as Iran, Indonesia, or the United Arab Emirates reinforces the geo-economic authenticity of this strategy. This coherent stance, expressed a couple of weeks before the Rio summit, marks a crucial action in the BRICS bloc’s financial disintermediation technique. It also leads the way for more technical discussions on the connection of regional payment systems and interoperability of national currencies, without crossing the institutional limit that a common currency would represent. A typical currency? A task still far from truth While the concept of a single currency within the BRICS has long captured attention, particularly in crypto and economic spheres, official statements have actually simply dampened short-term expectations. “Conversations around a typical BRICS currency are at a really preliminary stage,” said Dammu Ravi, the Indian agent of the group and secretary for financial relations. He added: “for now, we are focusing solely on settling exchanges in nationwide currencies. The harmonization of fiscal and monetary policies is extremely tough to attain.” This position equates India’s cautious stance, a crucial country in the bloc. Technical and political restraints are numerous. Monetary alignment needs long-lasting macroeconomic merging, however also institutional coordination which the BRICS presently do not have. Brazil acknowledged this as follows: “much deeper integration, such as a common currency, needs years of political alignment.” These words show that the ambition exists but the conditions for expediency are not yet satisfied. Economic divergences among members, in terms of inflation, exchange routines, or political stability, make complex any attempt at financial standardization. Even within the European Union, the process took a number of decades. Beyond the financial obstacle, the hesitation also reflects political realism. Rushing a common currency project might weaken group cohesion. The message sent to Rio is therefore one of progressive cooperation, based upon concrete common grounds such as localized trade, as evidenced by the shift to regional currencies, before potentially addressing a more ambitious financial union. From a geopolitical perspective, this practical method could reinforce the bloc’s authenticity and prevent internal stress. Eventually, technological developments, especially in sovereign digital currencies (CBDCs), could revive discussions in a various type.

Trade in regional currencies develops itself as a diplomatic concern While the dollar’s hegemony is coming to an end, Denis Alipov, Russian ambassador to India, mentioned that “the BRICS bloc is a major platform to discuss common options to significant challenges,” during a conference arranged in New Delhi by the Brazilian embassy and the Center for Global Viewpoints of India. In this regard, numerous points plainly emerge from these diplomatic exchanges: Trade in regional currencies is currently a reality amongst some BRICS members, significantly in between Russia, India, and China; This vibrant goals to lower reliance on the dollar in multilateral and bilateral transactions; The job is not presented as a conflict with the West, but rather as a lever for financial emancipation; The effort enjoys broad diplomatic consensus, unlike more delicate problems such as the common currency or bloc governance; The combination of new members such as Iran, Indonesia, or the United Arab Emirates enhances the geo-economic legitimacy of this strategy. It also paves the method for more technical discussions on the connectivity of local payment systems and interoperability of nationwide currencies, without crossing the institutional limit that a typical currency would represent. “Discussions around a typical BRICS currency are at an extremely preliminary phase,” said Dammu Ravi, the Indian representative of the group and secretary for financial relations. The message sent to Rio is for that reason one of steady cooperation, based on concrete typical grounds such as localized trade, as evidenced by the transition to local currencies, before potentially addressing a more enthusiastic monetary union.