The Rise of CoinFutures: Revolutionizing Crypto Futures Trading

The world of crypto futures trading has seen exponential growth, with the daily trading volume in crypto derivatives surpassing $24.6 billion, indicating a significant 16% year-over-year increase. According to a report by CoinLaw in July 2025, the crypto derivatives market hit a record monthly trading volume of $8.94 trillion, once again outpacing spot trading.

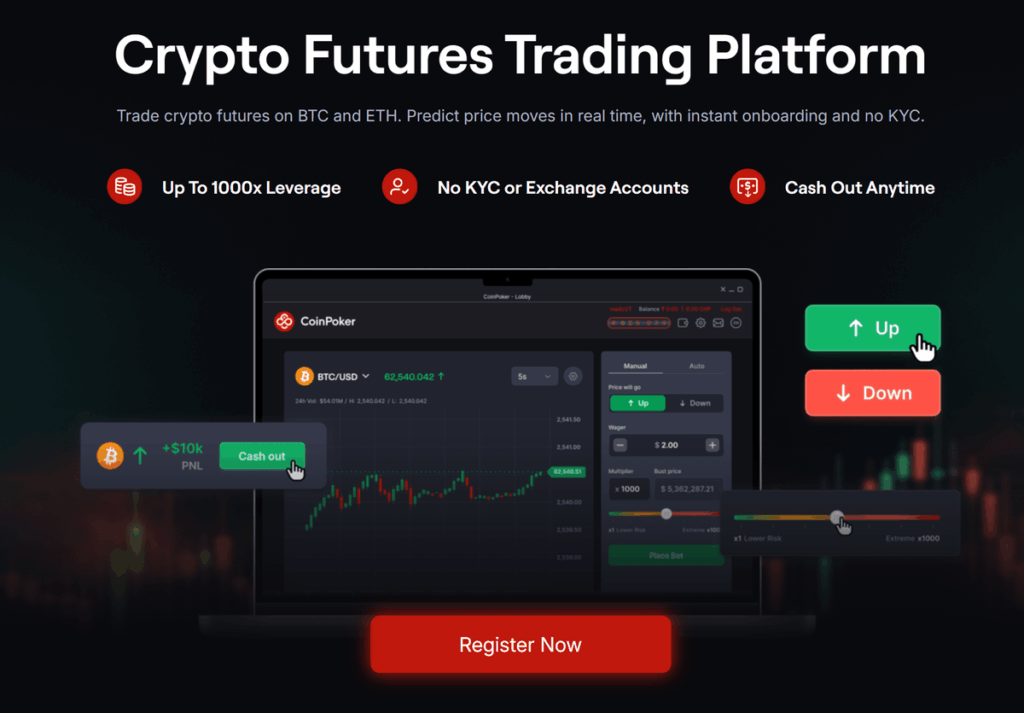

Leading the charge is CoinFutures, a cutting-edge platform that has garnered attention for its ability to streamline trading processes and reduce costs, allowing users to leverage the full potential of the crypto market.

The Appeal of CoinFutures

CoinFutures stands out for its emphasis on speed, simplicity, and user experience. This focus on user-centric design has made it a top choice among industry professionals and retail traders alike.

Industry Insights and Expert Forecasts

Industry experts are predicting significant price movements for major cryptocurrencies such as Bitcoin and Ethereum. In this volatile market environment, CoinFutures provides retail traders with the opportunity to enhance their profits through leveraged trading, capitalizing on these projected price swings.

Sam Boolman, ChainIntel’s lead analyst, notes, “The rise of platforms like CoinFutures underscores the increasing demand for efficient and user-friendly trading solutions in the crypto space. As investors seek to maximize their returns in a rapidly evolving market, platforms that offer speed and cost-effectiveness will continue to gain traction.”

The Future of Crypto Futures Trading

With platforms like CoinFutures leading the way in innovation and accessibility, the future of crypto futures trading looks promising. As the market matures and more traders embrace derivatives as a strategic tool, platforms that prioritize user experience and efficiency are poised to shape the industry’s landscape.