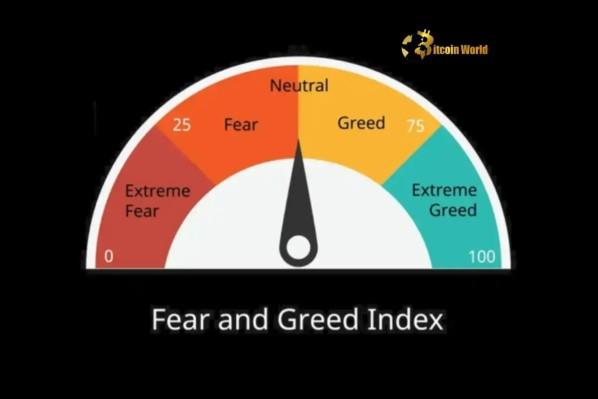

Crucial Shift: Crypto Fear and Greed Index Enters Neutral Zone

The relocation to 52 suggests that while straight-out ‘Greed’ is not yet dominant, the intense fear has actually decreased, changed by a more balanced, albeit potentially indecisive, market mood. This shift in crypto market belief doesn’t necessarily anticipate the future, but it reflects the present psychological state of market participants based on numerous data points. Understanding the Factors Behind the Index Score The index is not based on a single metric but aggregates data from 6 different sources. If the index shows severe greed however you feel fearful, or vice versa, it might prompt you to re-evaluate your position or strategy. Historical Context: Tracking the index over time offers context on market cycles and how belief has traditionally associated with rate movements. Remember, the index is simply one data point among lots of. Financiers should constantly be prepared for potential cost swings, regardless of the index’s existing reading. Looking Ahead: What May Push the Index Further? The index’s next relocation will depend on shifts in the hidden aspects.

For traders and financiers navigating the digital possession landscape, comprehending this index is key to interpreting prospective market movements. What is the Crypto Fear and Greed Index? The Crypto Worry and Greed Index, supplied by software development platform Option, is a popular tool utilized to gauge the basic sentiment in the cryptocurrency market. The move to 52 suggests that while straight-out ‘Greed’ is not yet dominant, the extreme worry has decreased, changed by a more balanced, albeit potentially indecisive, market mood. This shift in crypto market sentiment does not necessarily forecast the future, however it shows the current mental state of market participants based on various data points. Understanding the Factors Behind the Index Score The index is not based on a single metric however aggregates information from 6 various sources. If the index shows extreme greed but you feel fearful, or vice versa, it might prompt you to re-evaluate your position or strategy. Historical Context: Tracking the index over time offers context on market cycles and how sentiment has actually traditionally correlated with price movements. Remember, the index is just one information point amongst many. Financiers ought to always be prepared for prospective price swings, regardless of the index’s current reading. Looking Ahead: What May Press the Index Further? The index’s next relocation will depend on shifts in the underlying elements. Use this index as one tool among many to evaluate the market’s emotional temperature level, but always integrate it with persistent research study and analysis before making financial investment decisions. To find out more about the newest crypto market trends, explore our short articles on crucial developments forming Bitcoin and other cryptocurrencies’ future cost action.