Important Shift: Crypto Fear and Greed Index Goes Into Neutral Zone

Are you watching the crypto market carefully? A considerable sign, the Crypto Fear and Greed Index, has just moved into a new phase, recommending a shift in the prevailing crypto market sentiment. This post Important Shift: Crypto Worry and Greed Index Gets in Neutral Zone first appeared on BitcoinWorld and is composed by Editorial Group

BitcoinWorldCrucial Shift: Crypto Worry and Greed Index Gets In Neutral ZoneAre you enjoying the crypto market carefully? A significant indication, the Crypto Fear and Greed Index, has just moved into a brand-new phase, suggesting a shift in the dominating crypto market belief. For traders and investors navigating the digital asset landscape, understanding this index is key to analyzing potential market movements.

What is the Crypto Worry and Greed Index?

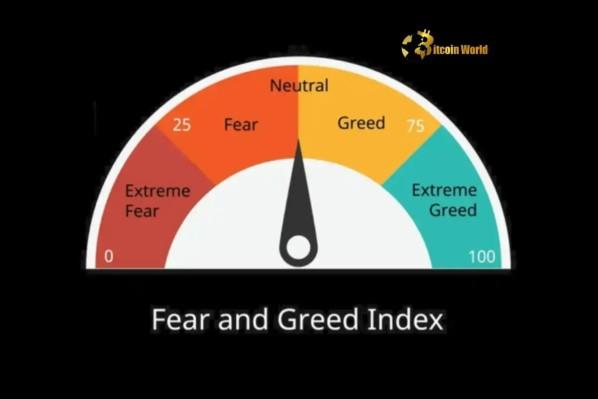

The Crypto Fear and Greed Index, provided by software advancement platform Alternative, is a popular tool utilized to evaluate the basic sentiment in the cryptocurrency market. It aims to measure the emotional state of market participants, which typically drives rate action. The index operates on a basic principle: extreme fear can signal a potential purchasing chance (as prices might be synthetically low due to worry selling), while extreme greed can recommend the marketplace is due for a correction (as costs may be pumped up by FOMO– Fear Of Missing Out). The index exists as a single number varying from 0 to 100: 0-24: Severe Fear, 25-49: Fear, 50-50: Neutral, 51-74: Greed, 75-100: Extreme Greed

The Current Shift: From Fear to Neutral Territory

As of June 7, the Crypto Fear and Greed Index registered a value of 52. This marks a significant increase of seven points from the previous day. This movement signifies a transition out of the ‘Worry’ zone and into the ‘Neutral’ zone. For a period, the marketplace had actually been defined by higher levels of worry, often connected with price slumps or unpredictability. The move to 52 suggests that while straight-out ‘Greed’ is not yet dominant, the intense worry has actually gone away, replaced by a more balanced, albeit possibly indecisive, market mood.

Understanding the Factors Behind the Index Score

The index is not based upon a single metric but aggregates data from six various sources. Each aspect contributes a specific weighting to the final score:

- Volatility (25%): This element measures the current volatility and maximum drawdowns of Bitcoin compared to its average values over the last 30 and 90 days.

- Market Momentum/ Volume (25%): This factor takes a look at the current market volume and momentum compared to average values over the last 30 and 90 days.

- Social Media (15%): This analyzes keywords related to cryptocurrency on platforms like Twitter.

- Surveys (15%): Although currently paused by Alternative, this component historically included weekly surveys asking individuals how they see the marketplace.

- Bitcoin Dominance (10%): Bitcoin supremacy steps Bitcoin’s share of the total cryptocurrency market capitalization.

- Google Trends (10%): This element examines search inquiries related to Bitcoin on Google Trends.

What Does ‘Neutral’ Sentiment Imply for Crypto Trends?

Moving into the ‘Neutral’ zone (50-50 range, with 52 being just above the midpoint) is frequently analyzed as a period of indecision or equilibrium in the market. It suggests that neither extreme fear nor extreme greed is currently dominating participant behavior. Here are some potential implications for crypto patterns:

- Absence of Clear Direction: The marketplace might trade sideways or exhibit choppy price action as bears and bulls are fairly balanced.

- Potential Juncture: Neutrality can precede a significant move in either direction. It is like a coiled spring, awaiting a catalyst.

- Increased Sensitivity to News: In a neutral state, the market may be more reactive to external news events, regulations, or macroeconomic data.

- Focus on Fundamentals: With emotional extremes suppressed, market participants may pay closer attention to project developments, adoption rates, and technological advancements.

How Can Investors Utilize the Crypto Fear and Greed Index?

The index is a sentiment tool, not a trading signal in isolation. It can be a valuable addition to an investor’s toolkit:

- Contrarian Sign: Some investors use the index as a contrarian signal.

- Market Confirmation: It can assist verify or question signals from other indicators.

- Emotional Check: It can help investors assess their own feelings against the prevailing market sentiment.

- Historical Context: Tracking the index over time provides context on market cycles and how sentiment has historically related to price movements.

Considering Crypto Volatility in the Neutral Zone

Even in a ‘Neutral’ sentiment phase, crypto volatility remains an essential quality of the market. The index’s volatility part contributes 25% to the score, reflecting how significant price swings influence overall sentiment. A neutral index doesn’t suggest volatility disappears; it just means the market isn’t currently driven by panic selling or manic buying based on recent price movements to the extreme degree seen during periods of ‘Extreme Fear’ or ‘Extreme Greed’.

Looking Ahead: What May Push the Index Further?

The index’s next move will depend on shifts in the underlying factors. Positive news regarding policy, institutional adoption, or significant technological upgrades within major projects could push sentiment towards ‘Greed’. On the other hand, negative news, regulatory crackdowns, or significant price drops may quickly send the index back into ‘Fear’. Changes in Bitcoin dominance and broader economic conditions will also play a role in shaping future crypto trends and the corresponding sentiment.

Conclusion: A Balanced Pause

The Crypto Fear and Greed Index moving to 52, entering the ‘Neutral’ zone, represents a pause in the previously fearful market sentiment. It indicates a more balanced environment where neither extreme panic nor widespread speculation is currently in control. While this doesn’t provide a clear directional signal, it highlights a potential period of indecision or transition for crypto trends. Understanding the factors affecting the index, from crypto volatility and market momentum to social media buzz and Bitcoin dominance, provides valuable context for investors.

For those keeping an eye on crypto trends, a neutral reading indicates relying solely on the index is insufficient. It’s a signal to look deeper into other technical and fundamental indicators.

To discover more about the latest crypto market trends, explore our articles on key developments shaping Bitcoin and other cryptocurrencies’ future price action.

This post Important Shift: Crypto Fear and Greed Index Gets in Neutral Zone first appeared on BitcoinWorld and is composed by Editorial Group