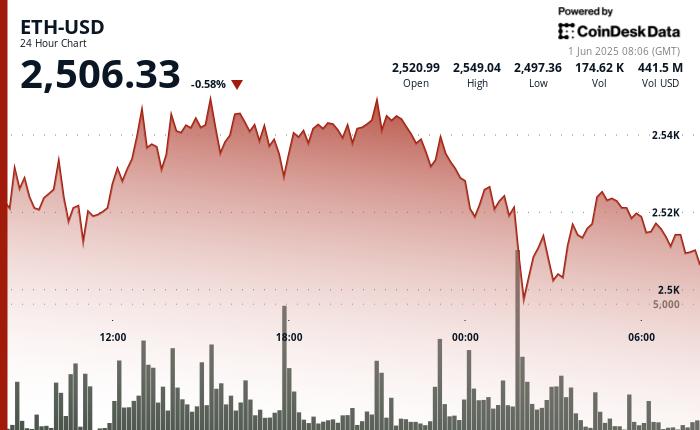

ETH Crashes to $2,499 as Binance Inflows Raise Whale Exit Worries

Ethereum (ETH) dealt with renewed drawback pressure in late trading, tumbling listed below the $2,500 level as offering volume rose and more comprehensive danger sentiment weakened. Global trade tensions and restored U.S. tariff threats have triggered risk-off flows, with digital possessions significantly mirroring traditional markets in their response to geopolitical uncertainty. On-chain data revealed sizable inflows to centralized exchanges– most notably 385,000 ETH to Binance– adding to speculation that institutional gamers may be trimming positions. Although ETH has since recuperated modestly to trade around $2,506, market observers are carefully watching whether buyers can safeguard this level or if another leg lower impends. Technical Analysis Highlights ETH traded within an unpredictable $48.61 range (1.95%) between $2,551.09 and $2,499.09. Price action formed a bullish ascending channel before breaking down in the last hour. Heavy selling emerged near $2,550, with profit-taking accelerating into a sharp reversal. ETH dropped from $2,521.35 to $2,499.09 between 01:53 and 01:54, with combined volume surpassing 48,000 ETH across two minutes. Volume stabilized soon after, and price recovered somewhat, consolidating around the $2,504–$2,508 band. The $2,500 level is now serving as interim support, though momentum remains delicate with signs of distribution still evident in current volume patterns.