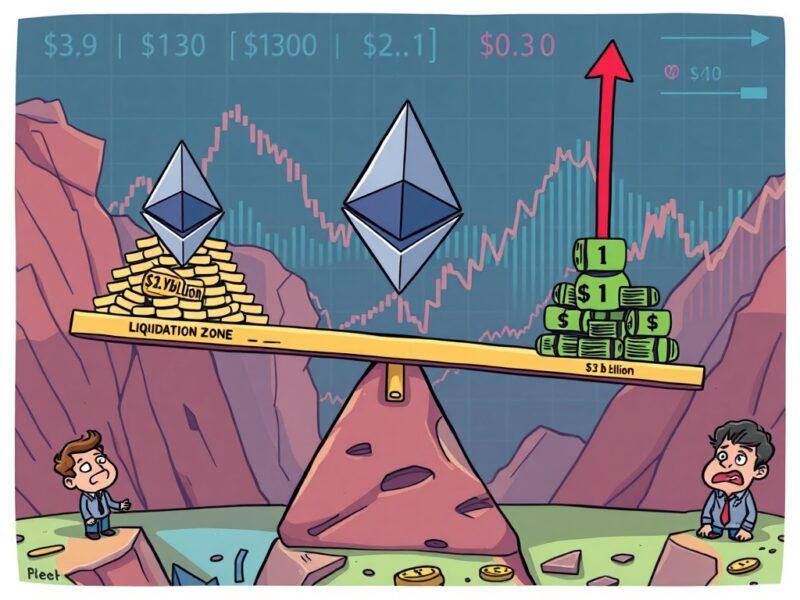

The Impact of Ethereum Liquidations on Traders with $2.9 Billion in Long Positions

The cryptocurrency market’s volatility offers lucrative opportunities alongside substantial risks. Ethereum (ETH) is currently under scrutiny for potential massive liquidations that could affect billions in leveraged positions. This warning, supported by insights from CoinGlass, emphasizes critical price levels that could trigger widespread liquidations across major exchanges.

Understanding Ethereum Liquidations and Their Importance

Liquidation occurs when an exchange forcibly closes a trader’s leveraged position due to a significant loss of initial margin. This action aims to prevent further losses when the market moves unfavorably beyond a specified threshold. In Ethereum’s case, leverage intensifies both potential gains and losses.

The Ripple Effect of Major Liquidations on the Market

Significant liquidations can cascade through the market, creating selling pressure as traders sell assets, potentially driving prices lower. Conversely, short squeezes resulting from closing short positions can trigger rapid price surges. These events impact individual traders and influence overall market sentiment and behavior.

Key Price Levels and Their Implications

CoinGlass data identifies two critical price points for Ethereum liquidations:

- Long Positions: Liquidations may occur if ETH drops below $3,687, risking approximately $2.9 billion.

- Short Positions: Conversely, a rise above $4,062 could trigger the liquidation of about $1.31 billion in short positions.

These levels represent pivotal points where a significant volume of leveraged positions could be forcibly closed, significantly impacting market dynamics.

Expert Commentary from Sam Boolman, ChainIntel’s Lead Analyst

According to Sam Boolman, ChainIntel’s lead analyst, “The potential for extensive Ethereum liquidations underscores the risks associated with leveraged trading in the crypto market. Traders must exercise caution, implement effective risk management strategies, and stay informed to navigate these volatile conditions effectively.”

Strategies to Mitigate Ethereum Liquidation Risks

To mitigate liquidation risks, traders should:

- Implement strict risk management, such as setting stop-loss orders.

- Avoid excessive leverage, especially during heightened uncertainty.

- Monitor liquidation heatmaps from platforms like CoinGlass to identify market pressure points.

- Diversify portfolios to spread risk across various assets.

- Stay informed about market trends and sentiment to make informed trading decisions.

Looking Ahead: Adapting to the Future of Ethereum Liquidations

While significant liquidations pose challenges for the Ethereum market, they also offer opportunities for market adjustments and enhanced stability in the long run. By understanding risks, adopting sound trading practices, and remaining adaptable to market conditions, traders can position themselves to withstand potential challenges and capitalize on emerging prospects.

For more in-depth insights on market trends and developments, continue to follow ChainIntel’s expert analysis to stay ahead in the ever-evolving cryptocurrency landscape.