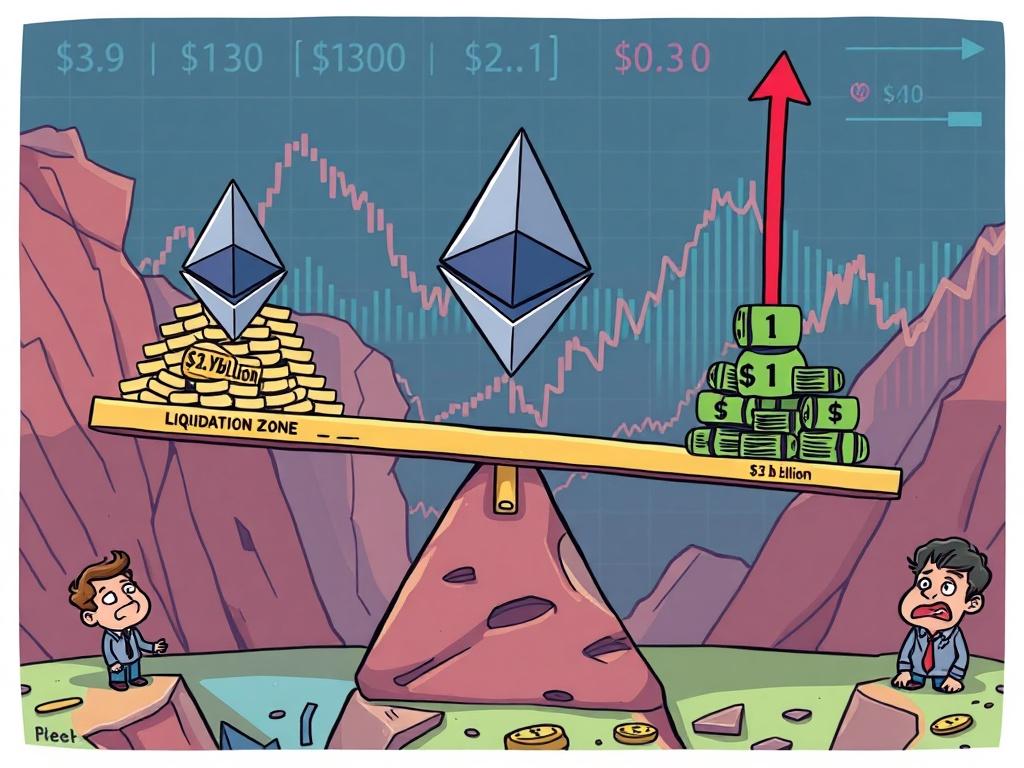

The Impact of Impending Ethereum Liquidations on a $2.9 Billion Long Position

The cryptocurrency market is renowned for its volatility, and Ethereum (ETH) is currently in the spotlight facing a significant threat of massive liquidations. This looming danger emphasizes the critical need for effective risk management strategies and heightened market awareness.

Understanding Crypto Liquidations

A crypto liquidation occurs when an exchange forcibly closes a trader’s leveraged position due to insufficient margin to cover potential losses. To prevent such events, traders must implement robust risk management practices, including the use of stop-loss orders and vigilant monitoring of market conditions.

Post-Liquidation Market Dynamics

Following a substantial liquidation event, the crypto markets often witness heightened volatility and potential shifts in investor sentiment. It is crucial to recognize that only leveraged or margin trading positions are susceptible to liquidation risks.

The Significance of $3,687 for Ethereum Liquidations

The price point of $3,687 represents a critical threshold as it signifies a substantial cluster of typical liquidation rates for long positions in the Ethereum market. Platforms like CoinGlass play a pivotal role in tracking potential liquidations by aggregating data from exchanges to identify vulnerable positions at specific price levels.

If you found this article insightful, please consider sharing it to raise awareness about the importance of risk management in the volatile crypto market.