Ethereum May Test Assistance Near $2,450 In The Middle Of Range-Bound Trading and Liquidity Levels

Ethereum’s cost action remains confined within a tight weekend variety, with important assistance and resistance levels forming trader sentiment. Liquidity pockets around $2,450 and $2,570 are essential zones affecting short-term price movements and liquidation events. According to COINOTAG sources, the interplay between whale activity and retail selling pressure could indicate an upcoming shift in market dynamics. Ethereum trades within a narrow range as liquidity clusters at $2,450 and $2,570 guide cost action, with whale activity hinting at possible trend changes.

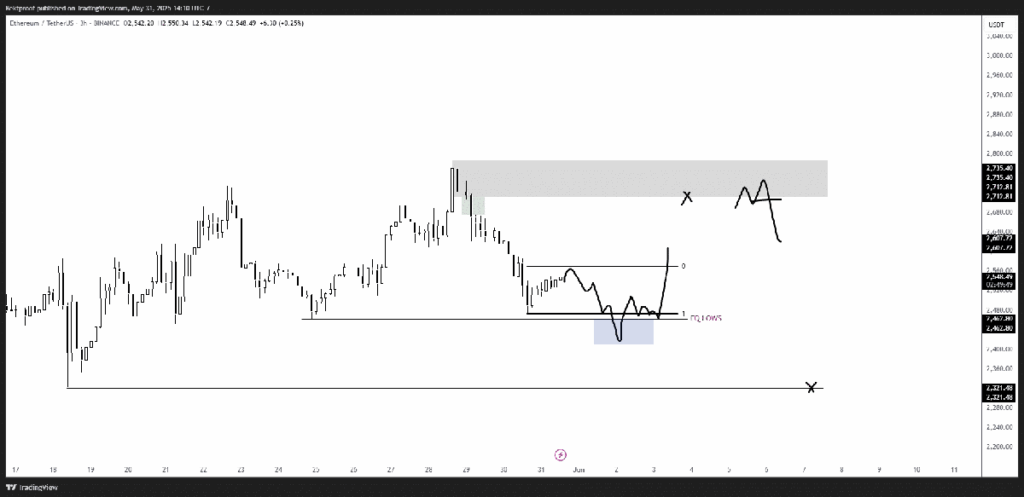

Ethereum’s Cost Combination and Liquidity Dynamics

Ethereum (ETH) continues to show a consolidation pattern characterized by oscillations in between specified liquidity zones. The recent cost habits highlights the value of the $2,450 and $2,570 levels, which have functioned as magnets for liquidation occasions and short-term trader interest. This range-bound movement reflects a market in search of direction, where both sellers and purchasers beware in the middle of more comprehensive macroeconomic uncertainties. Technical analysis exposes that the rate repeatedly evaluates these liquidity pockets, with sellers dominating throughout down probes and purchasers actioning in near support. The clustering of liquidation orders around these levels creates a feedback loop, intensifying volatility within the variety. This vibrant suggests that traders ought to closely keep an eye on these zones for potential breakout or breakdown signals, which might set the tone for Ethereum’s next directional relocation.

Whale Activity and Market Belief: Early Indicators of a Shift?

Current information suggests a subtle renewal of whale buying activity, juxtaposed versus a backdrop of heavy retail selling and capital outflows. This divergence has led to short-term unfavorable netflows, as large holders collect positions while smaller sized traders exit. COINOTAG analysts highlight that this pattern often precedes periods of increased market stability or trend turnarounds, as institutional participants capitalize on lower rates. The supremacy of taker sell volume recommends that bearish sentiment remains common in the short term. The interplay between these opposing forces develops a delicate balance, where the marketplace’s next directional predisposition will likely depend upon whether whale buying can absorb selling pressure efficiently. Traders are recommended to expect sustained volume modifications and cost action around crucial liquidity levels to evaluate the progressing sentiment.

Technical Insights from Current Market Analysis

Technical analyst RektProof’s recent commentary highlights Ethereum’s propensity to gravitate towards liquidity clusters, particularly around $2,462 before trying rallies to $2,560. This habits lines up with the observed price pattern over the past 10 days, where ETH experienced a sharp increase above $2,745 followed by a swift retracement. Such relocations are a sign of the market’s ongoing search for optimal liquidity zones to activate stop-loss orders and liquidations. The rejection of rallies above the $2,550 mark and the failure to go beyond recently’s highs reinforce the idea of a consolidative market stage. Traders need to think about these resistance levels as critical barriers that should be gotten rid of to signify a bullish breakout. Conversely, a sustained drop listed below $2,450 could open the door to deeper corrections, providing prospective buying chances for long-lasting financiers.

Liquidity Heatmap and Ramifications for Short-Term Trading

The liquidation heatmap from Coinglass even more illuminates the concentration of stop-loss orders and liquidation sets off clustered near the $2,450 and $2,570 marks. These zones act as critical battlegrounds where market participants’ positions are tested, typically leading to sharp price reactions. The $2,570 level, in specific, remains unswept, recommending a possible short-term bounce if buying pressure heightens. For traders, these insights stress the importance of keeping an eye on liquidation levels as prospective entry or exit points. The existing weekend range is anticipated to continue, with a likely retest of $2,450 providing a tactical purchasing opportunity focused on local highs near $2,800. This approach balances risk management with the capacity for profiting from prepared for price rebounds.

Conclusion

Ethereum’s present cost habits shows a market in consolidation, heavily influenced by liquidity clusters and the tug-of-war between whale build-up and retail selling. The important support and resistance levels at $2,450 and $2,570 act as key indications for short-term cost instructions. While bearish pressure remains evident, the resurgence of whale activity could declare a stabilization phase or trend reversal if sustained. Market individuals must stay vigilant, leveraging technical insights and liquidity heatmaps to browse this range-bound environment successfully.