Federal Reserve to Speak In The Middle Of Economic Shifts; Crypto Markets on Alert– Coincu

The post Federal Reserve to Speak Amid Economic Shifts; Crypto Markets on Alert– Coincu appeared on BitcoinEthereumNews.com.Key Points: A major decrease in U.S. Treasuries and dollar index impacts markets. Secret Federal Reserve authorities to speak this week. Traders eye prospective effects on Bitcoin and Ethereum. U.S. Treasuries experienced a considerable regular monthly decline as Federal Reserve officials prepared for numerous speeches this week across numerous platforms. Market participants focus on information such as non-farm payrolls, which might impact possession prices, consisting of Treasuries and cryptocurrencies like Bitcoin. Federal Reserve’s Impact on U.S. Treasuries and Dollar U.S. Treasuries faced their very first regular monthly decrease of 2025 in the middle of economic unpredictability. This trend lines up with the dollar’s fifth successive month-to-month drop, the longest since 2020, showing nuanced market shifts. Blended inflation data and tariff uncertainties have influenced these asset movements. Key speeches by Federal Reserve authorities are anticipated today, with figures like Chair Jerome Powell and Guv Christopher Waller supplying insight into policy directions. Their statements could possibly signal market reactions as they present at scheduled occasions and conferences. Anticipation runs high for these policy signals as markets evaluate modifications. “We are awaiting more data on how tariffs and other policy tools affect inflation and growth.”– Christopher Waller, Guv, Federal Reserve Markets and crypto traders are attentive to these developments, specifically Bitcoin and Ethereum markets, which have actually shown historical volatility in response to Treasury and dollar shifts. Economic and policy insights from Federal Reserve officials are crucial as markets incorporate these potential modifications. Federal Reserve Speeches: Prepared For Insights for Crypto Markets Did you understand? The 10-2 year Treasury yield curve’s inversion has actually historically predated U.S. recessions. Past cycles like 2020 saw similar Treasury movements and impacted both traditional and crypto markets due to unexpected policy shifts. Bitcoin (BTC) is currently valued at $104,065.08 with a market cap of $2.07 trillion, showing considerable market power. In spite of a 7.63% boost over …

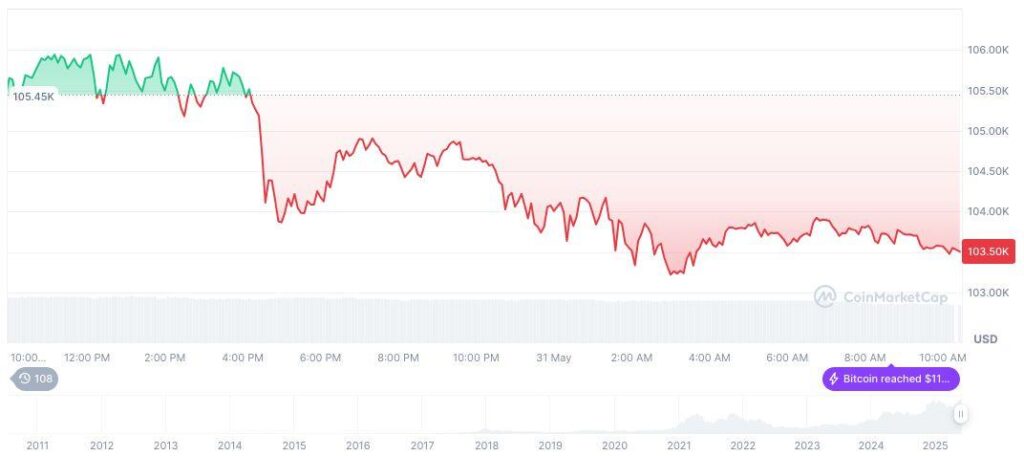

The post Federal Reserve to Speak Amidst Economic Shifts; Crypto Markets on Alert– Coincu appeared on BitcoinEthereumNews.com.Key Points: A significant decline in U.S. Treasuries and dollar index effects markets. Economic and policy insights from Federal Reserve authorities are vital as markets incorporate these potential modifications. Bitcoin (BTC) is presently valued at $104,065.08 with a market cap of $2.07 trillion, reflecting considerable market power. A significant decrease in U.S. Treasuries and dollar index impacts markets. Secret Federal Reserve authorities to speak this week. Traders eye potential results on Bitcoin and Ethereum. U.S. Treasuries experienced a significant regular monthly decline as Federal Reserve authorities got ready for several speeches this week across different platforms. Market participants concentrate on information such as non-farm payrolls, which may impact property prices, including Treasuries and cryptocurrencies like Bitcoin. Federal Reserve’s Impact on U.S. Treasuries and Dollar U.S. Treasuries faced their first regular monthly decrease of 2025 amid economic unpredictability. This trend lines up with the dollar’s fifth successive month-to-month drop, the longest since 2020, showing nuanced market shifts. Mixed inflation information and tariff uncertainties have actually affected these property movements. Secret speeches by Federal Reserve authorities are anticipated this week, with figures like Chair Jerome Powell and Guv Christopher Waller providing insight into policy directions. Their declarations might possibly signal market responses as they provide at scheduled occasions and conferences. Anticipation runs high for these policy signals as markets assess changes. “We are awaiting more data on how tariffs and other policy tools impact inflation and growth.”– Christopher Waller, Guv, Federal Reserve Markets and crypto traders are attentive to these advancements, especially Bitcoin and Ethereum markets, which have revealed historic volatility in reaction to Treasury and dollar shifts. Economic and policy insights from Federal Reserve officials are important as markets incorporate these prospective changes. Federal Reserve Speeches: Prepared For Insights for Crypto Markets Did you know? The 10-2 year Treasury yield curve’s inversion has historically predated U.S. economic downturns. Past cycles like 2020 saw comparable Treasury motions and affected both conventional and crypto markets due to sudden policy shifts. Bitcoin (BTC) is presently valued at $104,065.08 with a market cap of $2.07 trillion, reflecting significant market power. Regardless of a 7.63% boost over the previous 1 month, BTC saw a minor 2.86% decrease over the past week. The market dominance stands at 63.59%, as reported by CoinMarketCap. Bitcoin( BTC), day-to-day chart, screenshot on CoinMarketCap at 09:23 UTC on June 1, 2025. Source: CoinMarketCap Coincu’s research study team suggests that present financial shifts and Federal Reserve remarks could steer Treasury and currency markets, straight impacting crypto characteristics. Such macroeconomic indications show prospective for increased volatility throughout financial systems as policy clearness unfolds. Source: https://coincu.com/340977-federal-reserve-economic-shifts-crypto-alert/

— Christopher Waller, Governor, Federal Reserve Markets and crypto traders are mindful to these advancements, especially Bitcoin and Ethereum markets, which have shown historic volatility in reaction to Treasury and dollar shifts. Economic and policy insights from Federal Reserve authorities are crucial as markets incorporate these possible changes. Bitcoin (BTC) is presently valued at $104,065.08 with a market cap of $2.07 trillion, reflecting substantial market power. Source: CoinMarketCap Coincu’s research study group suggests that existing financial shifts and Federal Reserve remarks could steer Treasury and currency markets, directly affecting crypto characteristics.