FTX Begins 2nd User Payment Phase Distributing $5 Billion

FTX Trading Ltd. announced the launch of the 2nd phase of its user payment program, starting the distribution of over $5 billion to creditors starting today. The lenders of the bankrupt crypto exchange FTX are set to get their funds within 1 to 3 organization days, injecting liquidity back into the market.

FTX Disperses $5 Billion in Second Repayment Stage FTX Trading Ltd. has launched the 2nd phase of its payment program amidst its continuous insolvency procedures. This effort targets financial institutions impacted by the platform’s collapse, with over $5 billion set for distribution. The payments are assisted in by cryptocurrency entities BitGo and Kraken, accountable for ensuring the transfer of funds to qualified consumers. The repayment procedure represents a noteworthy shift, possibly affecting market movements. Customers will receive their returns mostly in cash or stablecoins, resulting from the liquidation of properties held by FTX. The financial investment neighborhood remains attentive as $5 billion re-enters the marketplace, possibly influencing cryptocurrency appraisals and trading characteristics. Market reactions are underway, with industry analysts forecasting possible increases in market liquidity. While the payments use financial relief to former FTX clients, neighborhood discussions have highlighted a preference for cryptocurrency circulations over cash.

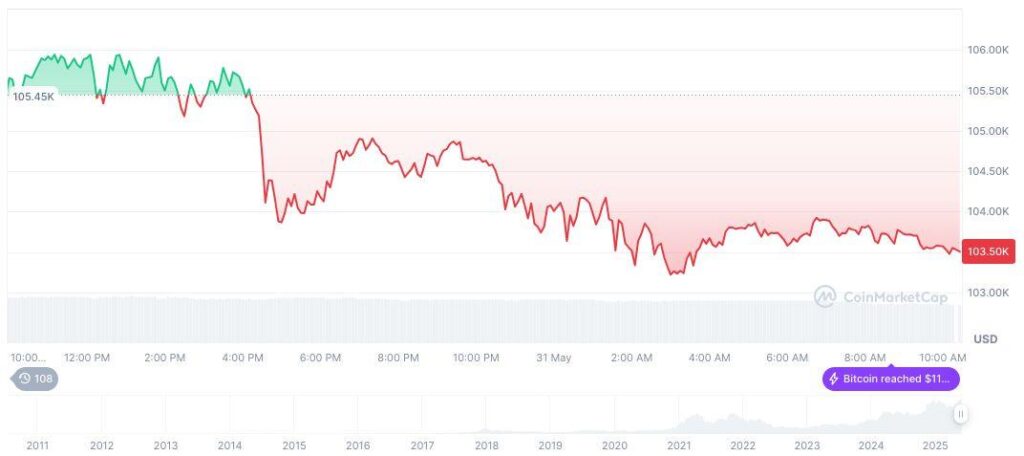

Parallels Drawn Between FTX and Mt. Gox Bankruptcies Did you know? In 2014, the Mt. Gox bankruptcy case set a comparable precedent. The phased payouts raised issues about prospective selloffs, much like continuous discussions relating to FTX’s repayments today. Bitcoin currently trades at $104,498.47, marking a 0.25% decline over 24 hours. Its market cap stands at $2.08 trillion, with a dominance of 63.44%. Notably, the 24-hour trading volume reached $42.82 billion. Bitcoin’s distributing supply is nearing its max of 21 million, as reported by CoinMarketCap. Coincu researchers emphasize the importance of transparency and rapid distribution in the consequences of FTX’s collapse, suggesting prospective ramifications for future crypto regulation. Observers are keen to view how liquidity redistributions might form market conditions and financier sentiment in the coming months.