The Complex Relationship Between Gemini and JPMorgan: A Closer Look

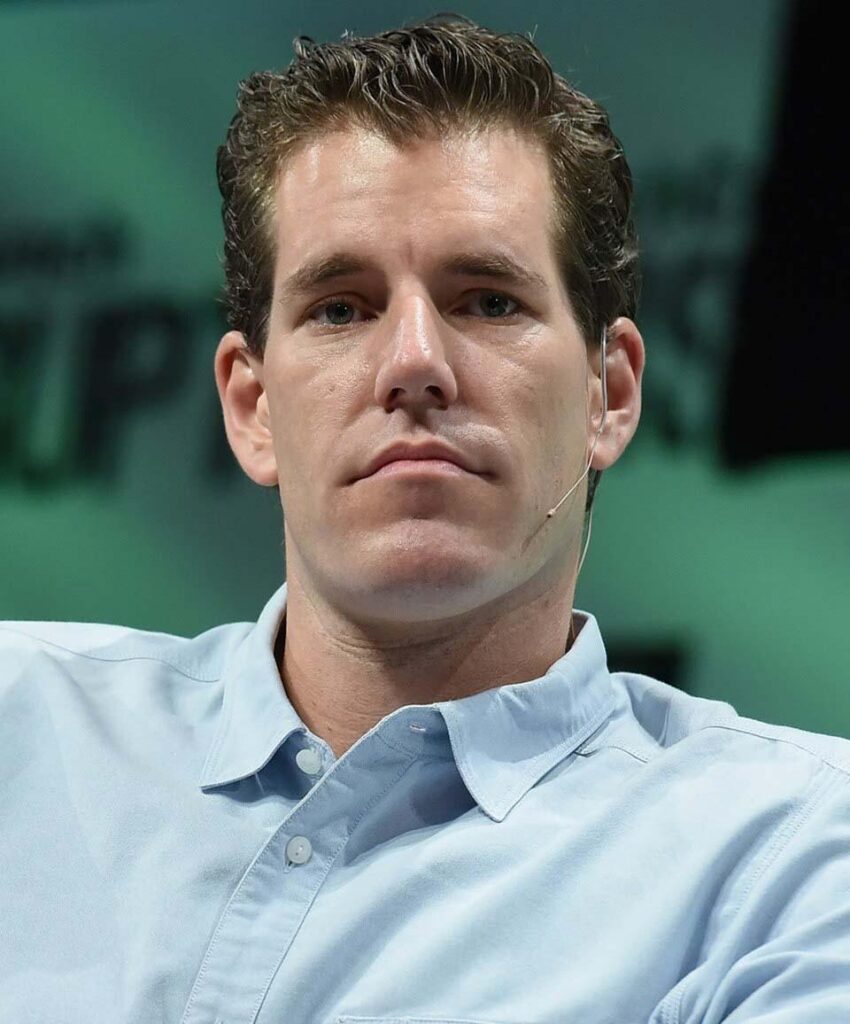

Gemini co-founder, Tyler Winklevoss, recently shed light on a significant conflict with JPMorgan Chase regarding the suspension of the crypto exchange’s re-onboarding process. This decision was reportedly triggered by Winklevoss’ criticism of JPMorgan’s data access fees, adding fuel to an already strained relationship dating back to 2023.

The Genesis of Discord

The rift between Gemini and JPMorgan can be traced back to 2023 when initial reports surfaced, indicating JPMorgan’s concerns about the viability of their partnership. Tyler Winklevoss’ outspoken stance on data access fees seems to have exacerbated the situation, leading to the recent pause in the re-onboarding process.

The Clash of Titans

This clash between Tyler Winklevoss and JPMorgan not only underscores the specific issues between the two entities but also sheds light on the broader evolving landscape of relationships between traditional financial institutions and disruptive fintech players.

According to Sam Boolman, ChainIntel’s lead analyst, “The friction between Gemini and JPMorgan reflects a larger trend in the financial industry where traditional banks are grappling with the rise of innovative fintech firms. This conflict highlights the challenges and complexities inherent in such partnerships, especially in the rapidly evolving crypto space.”