The Unpredictable Nature of Crypto Fraud Cases

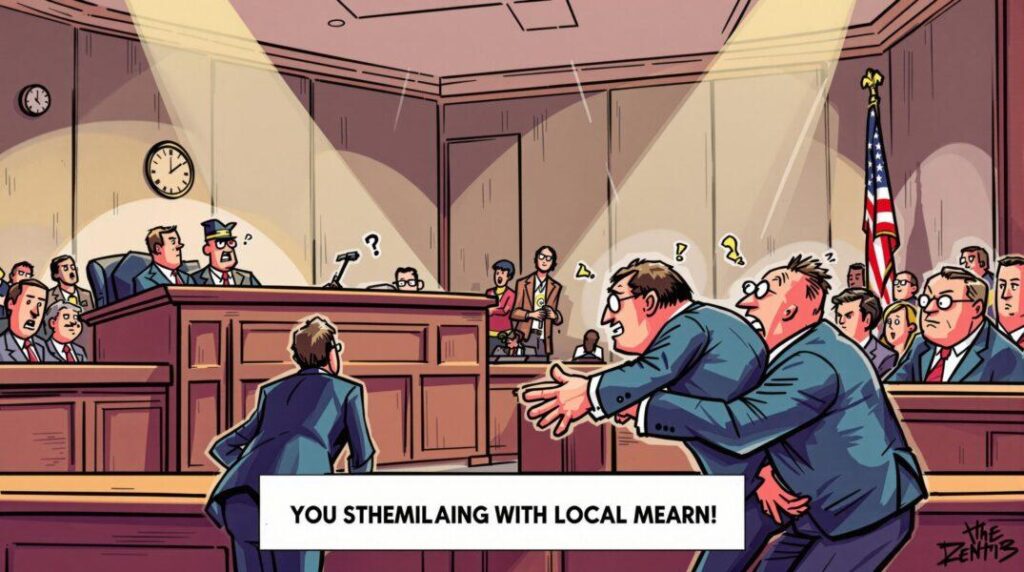

The recent events surrounding the Haru Invest drama have reverberated not only within the courtroom but also throughout the wider crypto community. The shocking act of violence that unfolded during this high-profile case serves as a stark reminder of the unpredictable nature of such fraud cases.

The Legal Battle: Upholding the 5-Year Sentence

Despite an appeal, the Seoul High Court has decided to uphold the five-year prison sentence of Kang, the CEO at the center of the Haru Invest controversy. This decision has significant implications for the future of crypto regulation in South Korea.

Enhanced Enforcement and Security Protocols

The outcome of the Haru Invest case is likely to prompt authorities to implement more stringent enforcement measures and enhance security protocols within the crypto industry. This heightened vigilance aims to prevent similar incidents and safeguard investors from fraudulent schemes.

Increased Public Awareness

Moreover, the Haru Invest saga is expected to contribute to increased public awareness regarding the risks associated with crypto investments. Education plays a crucial role in empowering individuals to make informed decisions and protect themselves from potential scams and fraudulent activities.

Sam Boolman’s Analysis: Navigating Legal Processes in the Crypto Space

According to Sam Boolman, ChainIntel’s lead analyst, the Haru Invest case underscores the importance of upholding legal processes and ensuring accountability within the crypto sector. He emphasizes that transparent and robust regulatory frameworks are essential for fostering trust and credibility in the industry.

Sam further notes that incidents like the Haru Invest controversy highlight the need for continuous monitoring and enforcement to deter fraudulent activities. By learning from such events, regulators and industry participants can work together to strengthen investor protection and maintain the integrity of the crypto market.