DOJ Ties Kansas Bank Collapse to $225 Million ‘Pig Butchering’ Seizure

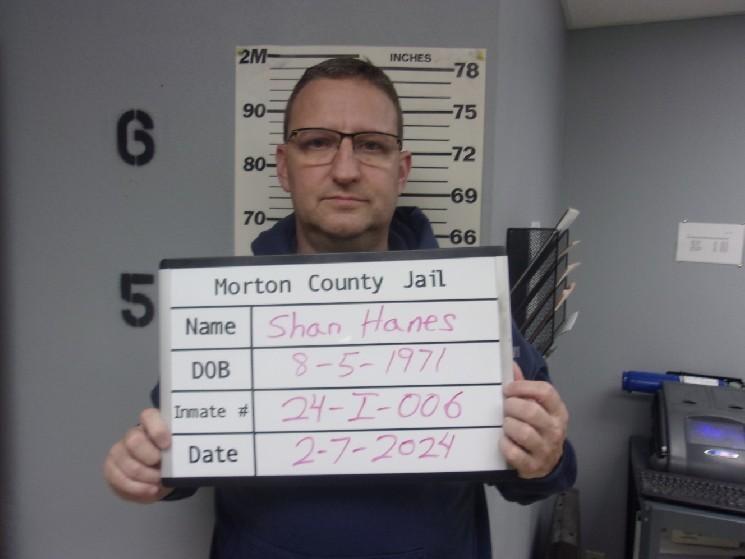

A Kansas lender who looted millions from his small-town bank in 2023, which triggered its collapse, lost much of the cash to overseas crypto scammers targeted in a record-breaking DOJ bust, according to a complaint filed Wednesday. Prosecutors have filed a civil forfeiture action targeting over $225 million in laundered USDT, part of a butchering scheme with ties to a Philippines call center that ensnared Shan Hanes, the disgraced former CEO who embezzled $47 million from Heartland Tri-State Bank, a theft which was directly linked to the agricultural lender’s demise in 2023.

According to the Department of Justice complaint, OKX, a crypto exchange, provided crucial information that helped identify a complex network of accounts on the exchange used to launder the crypto proceeds. Scammers laundered funds by directing victims to send USDT to 93 scam-controlled deposit addresses. The funds were then routed through as many as 100 intermediary wallets to obscure the source of funds and blend deposits from multiple victims. These laundered funds were funneled into 22 primary OKX accounts and further mixed across 122 additional OKX accounts, all connected by shared IP addresses, reused KYC files, and coordinated behavior traced to a Manila-based scam compound named ITECHNO Specialist Inc. In total, the DOJ states that approximately $3 billion in transaction volume was generated by this laundering network.

In total, the DOJ identified 434 victims and recognized 60 of them who lost a combined $19.4 million. The largest victim was Hanes, with the DOJ pinpointing $3.3 million of the $47 million he embezzled in this seizure. Hanes embezzled the money between May 30, 2023, and July 7, 2023, initiating 10 wire transfers totaling approximately $47.1 million from Heartland Tri-State Bank to a crypto wallet he controlled. These wire transfers occurred between the bank’s regulatory reporting periods, allowing the activity to go unnoticed initially. At the time of collapse in July 2023, Heartland was well-capitalized with $13.7 million in capital and $139 million in assets, but Hanes’ actions drained its liquidity, necessitated $21 million in emergency borrowing, and resulted in a $35 million capital deficit, leading to the bank’s closure.

Seized crypto assets are likely to be allocated to a forthcoming stockpile ordered by President Donald Trump. The Treasury Department is conducting an audit of governmental digital asset holdings to determine what should be collected. The long-term crypto holdings are expected to segregate seized bitcoin and other tokens into separate funds. The assets in this case mainly consist of USDT, according to the filing. The fate of the funds to be returned to victims remains uncertain, as only a small percentage of those affected have been identified.