Moscow Exchange Debuts Bitcoin ETF Futures for Qualified Investors

MOEX launches Bitcoin ETF futures for qualified investors, tracking BlackRock’s IBIT, settled in rubles. Retail investors blocked as MOEX debuts Bitcoin ETF futures for licensed professionals only. Russia carefully embraces crypto derivatives; MOEX uses IBIT-based futures with ruble settlement.

MOEX launches Bitcoin ETF futures for competent financiers, tracking BlackRock’s IBIT, settled in rubles. Russia opens crypto exposure through managed IBIT-linked futures on its top exchange, MOEX. Retail investors blocked as MOEX debuts Bitcoin ETF futures for certified professionals only. Russia cautiously adopts crypto derivatives; MOEX uses IBIT-based futures with ruble settlement. IBIT’s global success drives MOEX to offer futures agreements for select Russian investors.

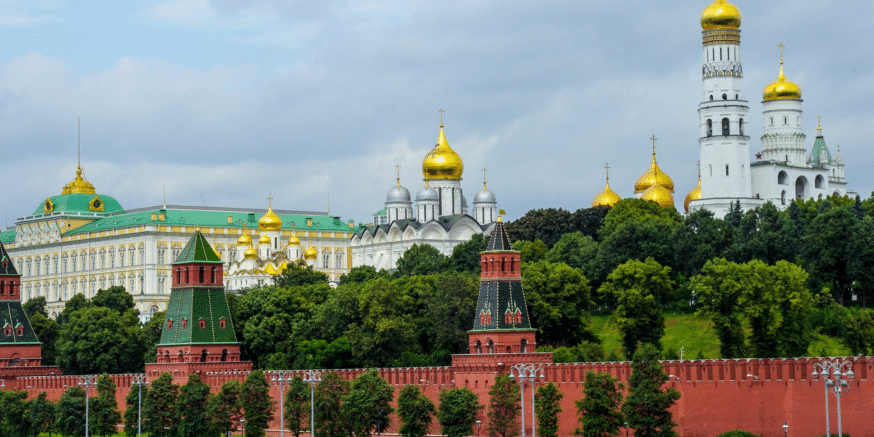

Russia’s leading stock exchange, Moscow Exchange (MOEX), has officially introduced Bitcoin ETF-linked futures for qualified investors. The new product tracks the value of BlackRock’s iShares Bitcoin Trust ETF (IBIT) settled in rubles but priced in U.S. dollars. The move marks Russia’s latest action toward regulated crypto exposure through traditional financial channels.

MOEX Introduces IBIT Futures Amidst Regulatory Support

MOEX began trading futures contracts linked to IBIT, offering quarterly expirations, with the first set for September 2025. These contracts allow investors to speculate on Bitcoin’s price without owning the asset directly, using a regulated platform. The initiative comes after Russia’s central bank approved limited crypto-related financial products for qualified investors.

MOEX confirmed that the futures are quoted in dollars per lot, although all settlements occur in rubles to align with local regulations. While the trading product mirrors IBIT, it does not involve direct crypto transactions or custody. Instead, it provides a structured option for gaining Bitcoin exposure within Russia’s regulated finance sector.

The exchange will commence investor qualification assessments on June 23 to ensure that only eligible traders can access the offering. This includes accredited individuals who meet strict income and experience criteria. Russia’s securities law allows such investors to access complex or higher-risk financial instruments like these futures.

Central Bank Sets Conditions as Retail Investors Excluded

Russia’s central bank has restricted access to crypto products, only permitting qualified investors to utilize these financial tools. The regulator remains cautious towards retail involvement in cryptocurrencies due to volatility and the risk of capital loss. Officials argue that crypto investment should remain a space for experienced market participants.

Retail investors, therefore, cannot participate in MOEX’s new futures offering, sparking disappointment across online investor communities. Many criticize the limited access and express a preference for direct crypto trading through international platforms. Despite this sentiment, authorities maintain their position, focusing on a measured rollout of crypto instruments. While public demand is increasing, regulatory focus remains on investor protection, legal compliance, and financial market stability.

IBIT Growth Reinforces Confidence in Futures Product

Since its launch in January 2024, the iShares Bitcoin Trust ETF has quickly become a leading financial product. As of June 3, IBIT ranked among the world’s top 25 ETFs by assets under management, totaling $72.4 billion. Its rapid rise strengthens confidence in MOEX’s decision to base futures contracts on this benchmark.

This global performance helps position IBIT as a reliable reference for local derivatives, despite Russian investors lacking direct access to U.S.-listed ETFs. MOEX leverages IBIT’s proven market strength to structure a futures product suitable for its qualified investor base. By doing so, the exchange aligns with global investment trends while respecting national policy.

Russia’s transition from restricting crypto policy to selective adoption reflects a broader shift in financial strategy. Instead of prohibiting digital assets, regulators are now establishing frameworks to integrate them into formal investment markets. This cautious approach aims to manage risk while meeting the growing demand for crypto exposure.

The article was originally published on CoinCentral.