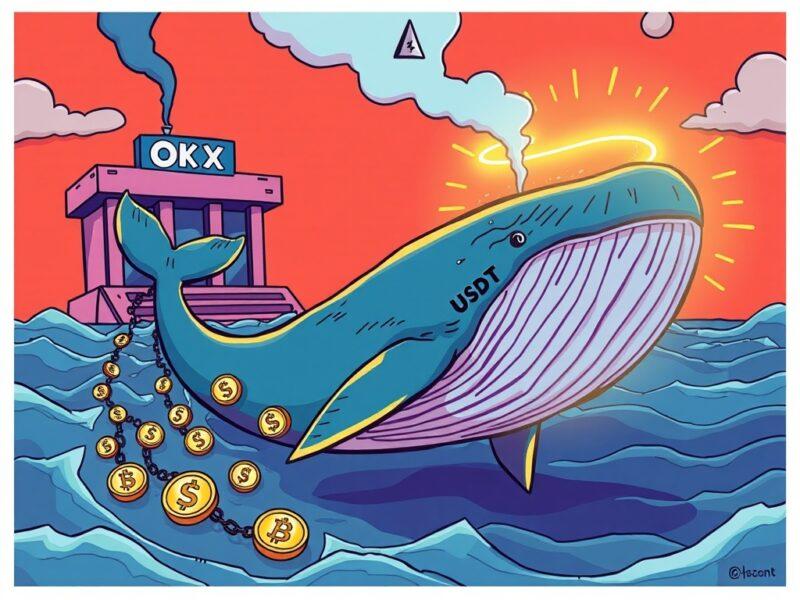

The Mystery Behind a $501 Million USDT Transfer from OKX

When a whale in the crypto world moves a substantial amount of USDT, it sends ripples through the market. While USDT transfers may not directly impact prices like Bitcoin or Ethereum transactions, their scale can have significant indirect effects on market sentiment and behavior.

Blockchain analysts and on-chain investigators meticulously trace these transfers, linking wallets to entities and deciphering transaction patterns. This process often unveils the identity behind these large movements, shedding light on the motives and strategies of these crypto whales.

Decoding the Implications of Massive USDT Transfers

Despite being a stablecoin pegged to the USD, large USDT transfers are closely monitored due to their representation of substantial capital shifts. These transfers can indicate strategic decisions by major players in the crypto space, influencing market sentiment and trading activities.

The Role of OKX in the Transfer

As the source of the $501 million USDT transfer, OKX’s security measures and operational integrity come under scrutiny. Each transfer leaves a transparent trail on the blockchain, allowing analysts to track and analyze the flow of funds, providing insights into the behavior and intentions of the entities involved.

Unveiling the Crypto Whales

A ‘crypto whale’ refers to an entity holding a significant amount of a particular cryptocurrency, capable of impacting its market dynamics through large transactions. By examining the frequency, timing, and scale of these transfers, analysts can infer the role and nature of these wallets, whether they belong to institutional custodians, individual investors, or treasury accounts.

Expert Commentary from Sam Boolman, ChainIntel’s Lead Analyst

According to Sam Boolman, the movement of such a substantial amount of USDT raises eyebrows in the crypto community. These transfers are not just about the numbers but also about the underlying strategies and intentions of the parties involved. It’s crucial for market participants to closely follow these events to better understand the dynamics of the crypto market.